Best Community

룸알바로 당신의 경력을 시작하세요: 새로운 기회의 문을 두드리다

룸알바는 경제적 자립과 경력 발전을 원하는 많은 이들에게 인기 있는 선택지가 되고 있습니다. 이 글에서는 룸알바의 다양한 면모와 이지알바를 통해 얻을 수 있는 기회들을 탐색합니다. 룸알바란 무엇인가? 룸알바는 주로 유흥업소에서 제공되는 아르바이트를 의미합니다. 다양한 업종과 지역에서 찾을 수 있으며, 특히 이지알바를 통해 다양한 일자리를 쉽게 찾을 수 있습니다. 이지알바는 사용자가...

안전놀이터: 이박사 플랫폼을 통한 신뢰할 수 있는 업체 탐색

이박사 플랫폼 소개 이박사 플랫폼은 안전놀이터 추천 및 보증업체를 소개하는 신뢰할 수 있는 정보 제공자입니다. 사용자들은 이 플랫폼을 통해 검증된 놀이터의 순위, 추천 리스트, 그리고 보증된 업체의 상세 정보를 쉽게 확인할 수 있습니다. 빅데이터와 철저한 검증 과정을 거친 업체만을 선별하여 제공함으로써, 사용자들에게 안전하고 즐거운 놀이 환경을 보장합니다. 이박사는 사용자의 만족을...

연체자대출의 혁신: 이지론과 함께하는 똑똑한 금융 여정

연체자대출의 정의와 중요성 연체자대출은 금융 상품의 한 종류로, 기존의 대출 서비스에서 제외된 개인들에게 새로운 기회를 제공합니다. 이러한 대출은 특히 금융적 어려움을 겪고 있는 사람들에게 중요한 역할을 하며, 이지론은 이들에게 맞춤형 금융 해결책을 제공하는 데 앞장서고 있습니다. 이지론 플랫폼은 연체자들의 상황을 이해하고, 그들의 요구에 부합하는 대출 옵션을 제공하여 금융 서비스의 접근성을...

카지노사이트 가입부터 플레이까지!

카지노사이트 소개: 온라인 카지노의 새로운 장 온라인 카지노 시장은 계속해서 성장하고 있으며, 이 중에서도 ‘카지노사이트’는 가장 빠르게 발전하는 분야 중 하나입니다. 사용자들은 이제 어디서든 인터넷만 연결되어 있다면 쉽고 편리하게 다양한 카지노 게임을 즐길 수 있게 되었습니다. 이러한 사이트들은 고품질의 게임, 안전한 결제 시스템, 그리고 매력적인 보너스와 프로모션을 제공하며 유저들의 마음을...

신뢰할 수 있는 안전놀이터 토토친구와 함께

토토친구는 사용자들에게 검증된 안전놀이터를 추천하는 데 앞장서고 있습니다. 우리의 목표는 사용자들이 신뢰할 수 있는 플랫폼에서 안전하게 베팅을 즐길 수 있도록 돕는 것입니다. 이를 위해, 우리는 빅데이터 분석과 철저한 검증 과정을 통해 최고의 업체만을 선별합니다. 안전놀이터의 중요성 안전놀이터의 선택은 온라인 베팅의 성공에 결정적인 역할을 합니다. 사용자의 개인정보 보호, 금융 거래의 안정성,...

안전놀이터의 검증된 보증업체 목록 공개

안전놀이터는 온라인 게임을 즐기는 이용자들에게 필수적인 정보입니다. 이용자들이 안전하게 놀 수 있는 곳을 찾는 것은 항상 중요한 일이며, 이를 위해 토토사이트와 카지노친구 플랫폼은 빅데이터와 검증을 통해 업체 정보를 제공하고 있습니다. 안전놀이터 추천 안전놀이터를 찾는 것은 매우 중요합니다. 안전놀이터는 이용자들이 신뢰할 수 있는 업체를 선택할 수 있도록 도와줍니다. 안전놀이터에서는 다양한 카지노...

파워볼 예측의 마법사, 베픽 커뮤니티와 함께하는 승리의 게임!

파워볼 예측, 베픽의 혁신적 접근법 파워볼 게임은 수많은 사람들에게 흥미로운 도전이지만, 무작위성의 벽 앞에서 많은 이들이 좌절합니다. 그러나 파워볼 예측에 혁신을 가져온 베픽 커뮤니티는 다릅니다. 수년간 축적된 빅데이터와 첨단 AI 분석기를 활용하여, 게임의 패턴과 가능성을 탐구합니다. 이러한 과학적 접근법은 단순한 추측을 넘어서, 실질적인 예측으로 이어집니다. 베픽이 제공하는 분석기를 활용하면, 사용자는...

호빠알바: 재미있는 경험 속 숨겨진 현실

호빠알바란 무엇인가? 호스트 바, 즉 ‘호빠’라는 말에서 알 수 있듯이, 남성 알바생이 손님을 모시는 일을 합니다. 고객 서비스의 한 분야로, 주로 여성 손님들의 대화 상대가 되며, 때로는 음료나 간식을 제공하기도 합니다. 왜 호빠알바에 관심이 많을까? 호빠알바는 독특한 경험과 높은 시급 때문에 많은 남성들에게 인기가 있습니다. 또한 소통의 기술을 키울 수...

여성대출 탐험기: 이지론에서 찾는 맞춤형 대출 해법

여성대출의 새로운 지평, 이지론이 제시하는 해답 여성을 위한 대출 시장은 끊임없이 진화하고 있습니다. ‘이지론’은 이 변화의 최전선에 서서 여성들에게 맞춤형 대출 상담과 서비스를 제공합니다. 이지론을 통해, 여성들은 자신의 금융 상황과 필요에 따라 최적화된 대출 상품을 쉽게 찾을 수 있습니다. 대출의 정의부터 시작해보겠습니다. 대출은 금융기관이나 대부업체로부터 일정 기간 동안 돈을 빌리고,...

카지노사이트의 모든 것: 추천부터 보증까지

카지노사이트 순위와 추천의 기준 카지노사이트를 선택할 때 가장 중요한 것은 신뢰성과 안정성입니다. 이를 위해 ‘카지노친구’와 같은 플랫폼이 빅데이터를 기반으로 순위를 매기고, 사용자들의 후기와 평가를 반영하여 추천 목록을 제공합니다. 사용자 경험을 극대화하기 위한 다양한 이벤트와 프로모션 정보도 중요한 선택 기준이 됩니다. 카지노사이트 가입 방법 및 프로모션 카지노사이트에 가입하는 방법은 간단하며, 일반적으로...

안전놀이터: 모든 이용자를 위한 신뢰할 수 있는 선택

안전놀이터와 토토친구: 안전한 베팅의 시작 안전놀이터는 사용자의 안전과 보안을 최우선으로 하는 온라인 베팅 플랫폼입니다. 토토친구와 협력하여, 이 플랫폼은 사용자에게 검증된, 신뢰할 수 있는 베팅 환경을 제공합니다. 여기에서는 빅데이터를 활용하여 각 업체의 신뢰도를 평가하고, 사용자가 쉽게 최고의 선택을 할 수 있도록 돕습니다. 보증업체 및 검증업체: 안전한 베팅을 위한 단계별 접근 토토친구는...

카지노사이트 – 온카의 신뢰와 흥미를 탐험하다

온카 플랫폼 소개 온카는 사용자들에게 신뢰할 수 있는 카지노사이트 추천 및 정확한 순위 정보를 제공합니다. 이 플랫폼은 빅데이터를 활용하여 각 카지노사이트의 신뢰도와 인기도를 분석하며, 사용자들에게 최적의 게임 경험을 제공하기 위해 끊임없이 노력합니다. 카지노사이트 순위 및 추천 시스템 온카의 카지노사이트 순위 시스템은 투명하고 정확한 데이터 분석을 기반으로 합니다. 사용자들은 여기서 다양한...

안전놀이터 탐방기: 이박사와 함께하는 보증 세계관!

안전놀이터의 중요성과 이박사의 역할 안전놀이터란 사용자의 안전과 보안을 최우선으로 고려하는 온라인 플랫폼을 의미합니다. 이러한 플랫폼들은 엄격한 검증 과정을 거쳐 사용자에게 신뢰성 있는 서비스를 제공합니다. 이박사는 이런 안전놀이터를 추천하고 보증하는 데 중점을 두는 플랫폼으로, 사용자들에게 검증된 놀이터 목록을 제공합니다. 이박사에서 제공하는 빅데이터 기반 추천 시스템 이박사 플랫폼은 빅데이터를 활용하여 각 사용자의...

파워볼의 비밀, AI가 들춰낸 빅데이터의 패턴!

파워볼 동행복권의 특징 흥미로운 숫자 게임, 그것이 바로 ‘파워볼’입니다. 한때 나도 파워볼에 빠져 토론을 나눈 적이 있다. 그 감동의 순간, 숫자가 내 편이 되어주기를 바라며. 파워볼은 그 미스터리한 매력에 사람들을 끌어들인다. 이용방법은 어떻게 되나요? 다양한 사이트에서 파워볼에 참여할 수 있습니다. 간단한 가입 절차 후, 원하는 번호를 선택하면 됩니다. 그런데, 어떤...

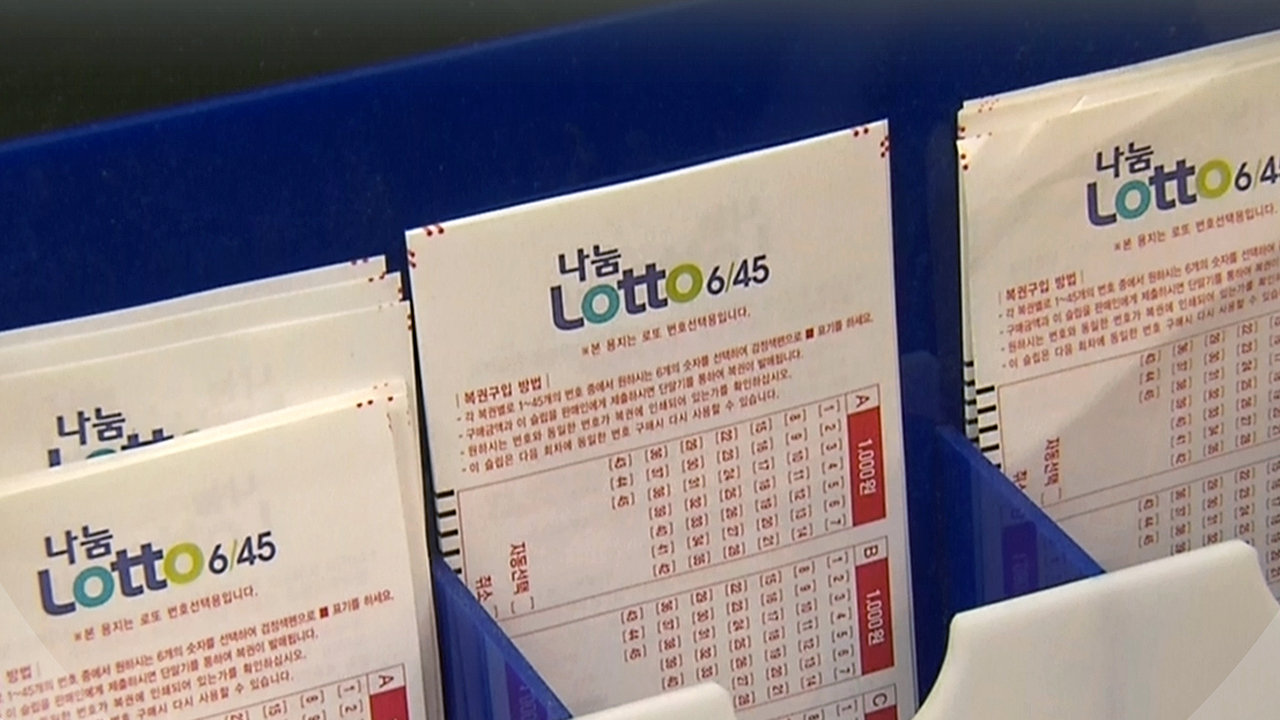

로또 645의 세계에 오신 것을 환영합니다: 당첨의 비밀을 풀다

로또 645는 단순한 운의 게임이 아닙니다. 여기에는 확률, 분석, 그리고 빅데이터가 얽혀있습니다. 매주 우리는 당첨번호를 안내하며, 그 뒤에 숨겨진 과학을 탐구합니다. 당첨번호 분석: 확률과 통계의 만남 당첨번호는 무작위로 보이지만, 사실은 확률과 통계의 규칙을 따릅니다. 우리의 전문가들은 이 데이터를 분석하여 로또번호의 추세와 패턴을 예측합니다. AI와 빅데이터를 활용한 로또번호 추천 최첨단 AI...

스웨디시 마사지의 숨겨진 이야기

스웨디시 마사지란? 스웨디시 마사지는 굉장히 유명한 테크닉을 기반으로 하는 전통적인 마사지 기법 중 하나입니다. 체계적이고 부드러운 움직임이 특징이며, 체내의 순환을 촉진시키고 긴장을 풀어줍니다. 효과는 어떤 것이 있나요? 스웨디시 마사지는 근육의 긴장을 풀어주며, 혈액 순환을 촉진시킵니다. 이로 인해 스트레스와 피로가 해소되며, 일상 속에서 잠시나마 휴식을 가져올 수 있습니다. 가격비교와 최저가 검색...

밤알바 세상: 밤이면 펼쳐지는 다채로운 일터의 세계

밤이면 도시는 다른 얼굴을 보여줍니다. 불빛 아래, 수많은 사람들이 일을 시작하는데, 그들 중에는 ‘밤알바’로 불리는 사람들도 많습니다. 밤알바의 매력 다른 일과 다르게 밤에만 활동하는 밤알바는 특별한 매력이 있습니다. 조용한 도시, 활기찬 밤 문화, 그리고 다양한 사람들과의 만남. 밤알바를 통해 세상을 새로운 시각으로 바라볼 수 있습니다. 다양한 밤알바 일자리 콘서트장에서의 안내원,...

전당포대출, 전문가가 알려주는 재치 있는 이용 방법!

전당포대출이란? 전당포대출은 전통적인 방식의 대출로, 소중한 물건을 잠시 맡기고 그 가치에 맞는 금액을 대출 받는 방식입니다. 한 때 나도 이 방식을 이용해 보았는데, 생각보다 간편하고 편리했습니다. 종류와 추가 설명 전당포대출에는 다양한 종류가 있습니다. 주로 보석, 시계, 금, 은 등의 귀금속이나 명품 핸드백 등의 물건을 담보로 하는 경우가 많습니다. 각각의 물건에...

미수다 알바의 신비한 세계

유흥 알바의 현실 첫걸음을 내디딜 때 느꼈던 긴장감, 지금은 웃음으로 되돌아볼 수 있다. 유흥 알바의 세계는 예상보다 훨씬 다양했다. 급여, 업체 정보, 면접 과정, 일자리 안내 등 많은 정보를 얻을 수 있었다. 취업 준비의 시작 여러 업체 목록을 찾아보며 하나하나 알아가는 과정은 나만의 길을 찾는 것 같았다. 지역별, 업종별 업체...

우리카지노를 선택해야 하는 이유: 추천 계열과 최신 인기 프로모션을 한 눈에!

안녕하세요, 카지노 애호가 여러분! 여러분이 우리카지노를 선택해야 하는 이유를 알아보려고 합니다. 이곳은 뛰어난 보증과 검증 과정을 거친 게임들, 그리고 풍성한 이벤트와 프로모션으로 유명합니다. 지금부터 그 세부 사항을 함께 살펴보겠습니다. 1. 검증된 게임들: 안전하게 즐기세요! 우리카지노는 엄격한 검증 과정을 통해 여러분에게 안전한 게임 환경을 제공합니다. 모든 게임들은 공정하고 투명하게 운영되며, 이는...